This is basically the person who makes or executes a promissory note and pays the amount therein. If the holder of the promissory note dies the obligation of the borrower may become unclear.

The Party Making The Promise To Pay The Promissory Note Is The - If you're searching for picture and video information related to the keyword you've come to pay a visit to the right blog. Our website gives you hints for viewing the maximum quality video and image content, search and locate more enlightening video articles and images that match your interests. includes one of thousands of movie collections from several sources, particularly Youtube, therefore we recommend this movie that you view. This blog is for them to visit this website.

Simple Collateral Loan Agreement Template Collateral Loans Loan Agreement Loan

The promissory note may.

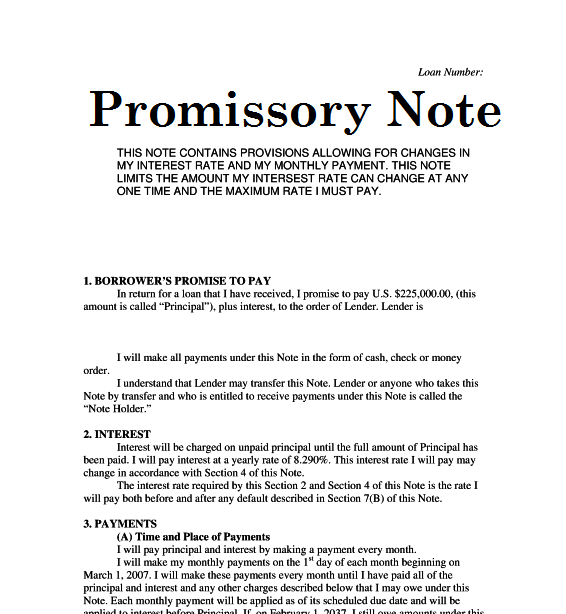

The party making the promise to pay the promissory note is the. A promissory includes all the terms of repayment including the rate of interest the due date and the number of payments to be made. It is a written agreement signed by drawer with a promise to pay the money on a specific date or whenever demanded. An individual may sign a promissory note when she wants to make a purchase but does not have the cash to pay for the item.

The drawer of a promissory note is the maker and the debtor. 1 A promissory note is an unconditional promise in writing made by one person to another person signed by the maker engaging to pay on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person or to bearer7. Consumers also sign promissory notes when they need to borrow money.

The drawer issues the promissory note and promises to pay a certain amount to the drawee payee. These include the maker the payee as well as the holder. SECURITY - This includes any rights of possession in relation to the Security described in Section 2.

A The party making the promise to pay is called the maker. Promissory notes are used for a wide variety of loans including but not limited to bank loans commercial loans student loans and real-estate loans. Accepts a 1000 3-month 12 promissory note in settlement of an account with Tani Co.

A promissory note is a legal financial tool declared by a party promising another party to pay the debt on a particular day. A promissory note or promissory letter is a legal instrument that provides the details of a contractual agreement between two parties. A promissory note is a financial instrument that contains a written promise by one party the notes issuer or maker to pay another party the notes payee a definite sum of money either on.

Its a contractual agreement that involves two parties a promisor the person who is required to pay the money back and the promissee the lender that contains a specific set of repayment terms. A Promissory Note as the name itself gives a brief description is a legal financial instrument issued by one party promising to pay the debt owed to another party. Parties to Promissory Notes.

The party to whom payment of a promissory note is to be made Percentage-of-recievables basis Management estimates what percentage of recievables will result in losses from uncollectible accounts. We begin with the drawer and the drawee. For a contract to be legal you need consideration which is an exchange of value.

They are often basic documents with few formalities. Purpose of Promissory Note. Borrower shall pay all costs incurred by Lender in collecting sums due under this Note after a default including reasonable attorneys fees.

Two main parties involved in a promissory note. A promissory note is a legal contract that sets out the terms of a loan and enforces the promise for a borrower to pay back a sum of money to a lender within a certain time period. Promissory notes are one of the simplest ways to obtain financing for your company.

B The party to whom payment is to be made is called the payee. A promissory note is a signed and legally binding document containing a written promise by the borrower to pay a stated sum to a specified person or the bearer at a specified date or on demand. This note is a short-term credit tool which is not related to any currency note or banknote.

ATTORNEYS FEES AND COSTS. All outstanding sums owed on this Note to be immediately due and payable. The Promissory note contains a promise or undertaking to pay a certain sum of money.

Like a loan agreement a promissory note is a contract between two parties in which one agrees to repay the other according to the stipulations of the agreement. As the name suggests a promissory note is a promise to pay. C A promissory note is not a negotiable instrument.

Section 4 of the Negotiable Instruments Act 1881 defines Promissory note as an instrument in writing not being a bank note or currency note containing an unconditional undertaking signed by the maker to pay a certain sum of money only to or to the order of a certain person or to the bearer of instrument. D A promissory note is more liquid than an account receivable. Every promissory note always comprises of three important parties.

Even endorsers and endorsees can be parties in certain cases. He is also called the promisor.

Promissory Note Templates 16 Free Word Excel Pdf Formats Samples Types And Benefits Of Promissory Note Promissory Note Notes Template Word Template

Promissory Note Template 606 Note Templates Note Template Promissory Note

Printable 11 Sample Format Promissory Note Philippines In 2020 Notes Promissory Note Templat Promissory Note Note Template Notes Template

Printable Promissory Note Meaning Format Example Types Features Short Term Promissory Note Te Promissory Note Notes Template Business Notes

Printable Sample Simple Promissory Note Form Promissory Note Payoff Letter Lettering

Goal Setting Promissory Note

Blank Promissory Note Form Promissory Note Note Templates Notes Templates

Simple Promissory Note Real Estate Forms Promissory Note Lettering Real Estate Forms