Note Third-Party Sick Pay at the top of the form. Sick pay paid by a third party on behalf of employers to employees in situations in which the liability for the Federal Insurance Contributions Act FICA taxes on the sick pay is split between the employer and the third party under applicable regulations.

Is Third Party Sick Pay Taxable - If you're looking for picture and video information linked to the keyword you've come to pay a visit to the ideal site. Our website gives you suggestions for seeing the highest quality video and picture content, hunt and find more enlightening video articles and images that fit your interests. comprises one of tens of thousands of video collections from various sources, particularly Youtube, so we recommend this movie for you to view. You can also contribute to supporting this website by sharing videos and images that you enjoy on this blog on your social media accounts like Facebook and Instagram or educate your closest friends share your experiences concerning the simplicity of access to downloads and the information you get on this site. This site is for them to stop by this site.

What Is Third Party Sick Pay

Free Results 247 For You.

Is third party sick pay taxable. Sick pay paid to the employees estate or survivor at any time after the employees death is not subject to income tax withholding regardless of who pays it Payments or parts of payments attributable to after-tax dollars are. As long as the third-party sick pay is treated as taxable income to the recipient it is considered compensation for the purpose of contributing to an IRA. Third party are not subject to FIT.

Any portion of sick pay paid by a third party that is. The non-agent does not have to withhold federal income tax on sick pay.

Depending on the coverage plan premium costs. Enter your employer payroll tax. Forms 8922 must be filed instead of the Form W-2 and Form W-3 third-party sick.

Usually the third party will withhold and deposit the employee social security and Medicare and you the employer will be responsible for the employer social security Medicare and FUTA. Free Results 247 For You. Are long-term disability benefits reported differently.

None of the sick pay is considered taxable. It must be reflected on Line 1a of PA-40 and it is the employers andor the agents responsibility to ensure the correct reporting of PA wages in Box 16 if all the conditions are met.

Include the SSN and the name of each recipient. Third party sick pay not taxable to PA is not an adjustment on the return. Save now at GigaPromo.

Do I need to withhold Minnesota income tax on third party sick pay. For employees this means the third-party sick pay is included in Box 1 of their Form W-2. Employer supplemental unemployment benefits SUB pay.

If a third party handles sick pay and they are not your agent they are responsible for handling employment taxes. Yes third-party sick pay is taxable unless the insurance premiums are paid with after-tax dollars.

American Fidelity will assume tax reporting for the first full calendar year following 6 months of. Get Instant Quality Results at iZito Now. They must use their own EIN Employer Identification Number and name for tax reporting purposes.

Sick pay includes both short-term and long-term benefits often expressed as a percentage of the employees regular wages. Employer and send a separate DE 9C listing all sick pay paid by a third-party payer as total subject wages and PIT wages. Sole Proprietorship - The owners parents spouse and children under the age of 18 wages are not subject.

Employee contributions to retirement plans and tax deferred annuity plans including Sec. If the employer pays the entire insurance premium then the sick pay payments received are 100 taxable to the employee. Third-party sick pay describes payments received by employees through private insurers or state disability insurance funds for wage continuation during a qualified non-work-related disability-related.

Third-party payer of sick pay is considered the employer and is responsible for withholding paying depositing and reporting taxes on sick payments unless this responsibility is transferred to the actual employer. When paid by a third party sick pay is subject to social security Medicare and FUTA taxes. Ject and therefore their wages are not taxable.

Third-party sick pay reported in box 12 with Code J is not taxable. Note that in any of the scenarios where the employee is taxable the employer is still responsible for matching Social Security and Medicare and withholding any Federal Unemployment Tax Act FUTA and State Unemployment Tax Act SUTA amounts.

Additionally a return containing a W-2 with 0 in box 1 will reject if e-filed Third party sick pay reported in Box 1 of the W-2 is considered taxable income and should be reported as such. All other employees wages are subject.

Find Everything about third party and Start Saving Now. Partnership - The partners wages are not subject. Vacation Sick Time Paid in a Lump Sum Wages 2 SCorp Shareholder Health Insurance Non-Taxable Auto Travel Reimbursements Moving Expense Reimbursement Disability Insurance Benefits Supplemental Unemployment Benefits SUB Pay Third Party.

Taxing of Third Party Sick Pay Payments. Get Instant Quality Results at iZito Now. Third Party Sick Pay You may need to withhold Minnesota tax on third-party sick pay employees receive for absences due to injury sickness or disability.

When it comes to third party sick pay its unlikely that the employer would be required to file the Form 8922. Sick pay including third-party sick pay before 2007.

Compensation attributable to a non-qualified deferred compensation plan at the time the compensation is deferred.

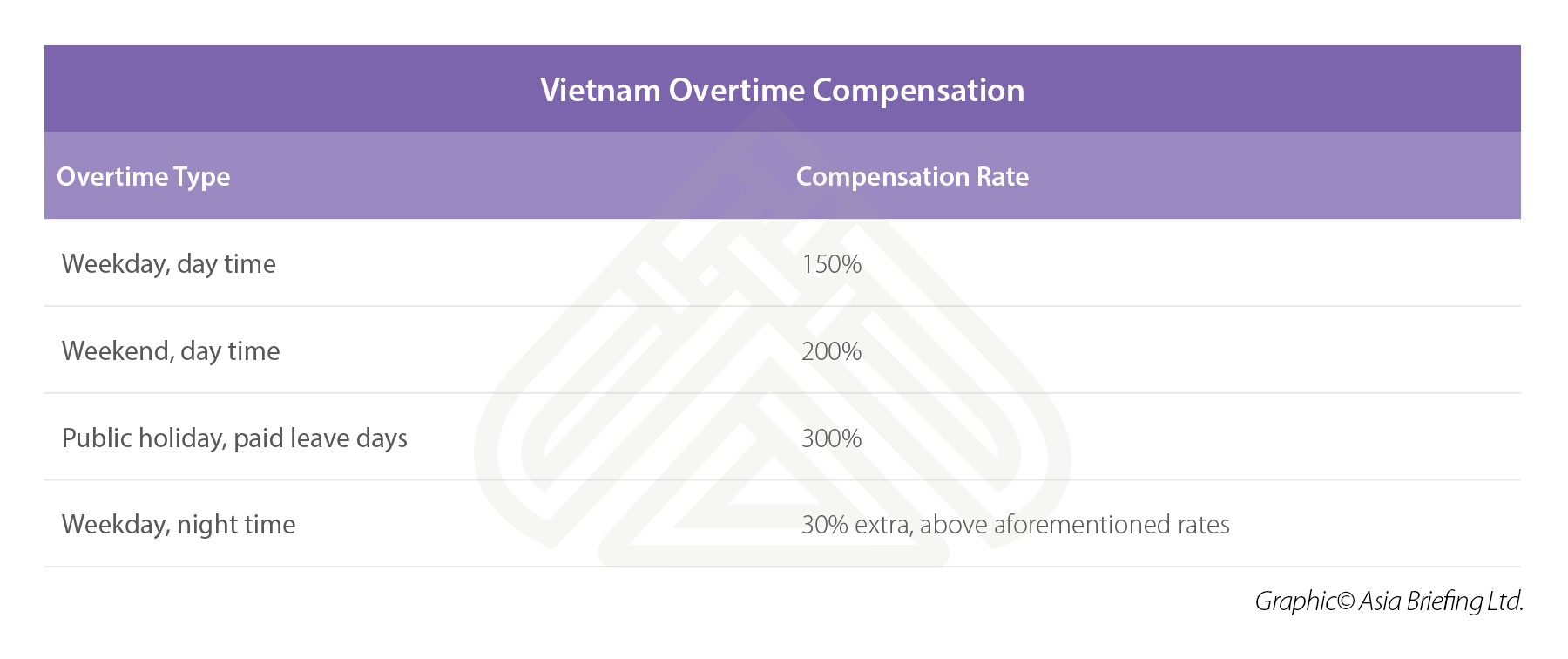

Payroll In Vietnam A Guide To Compensation Bonuses And Benefits

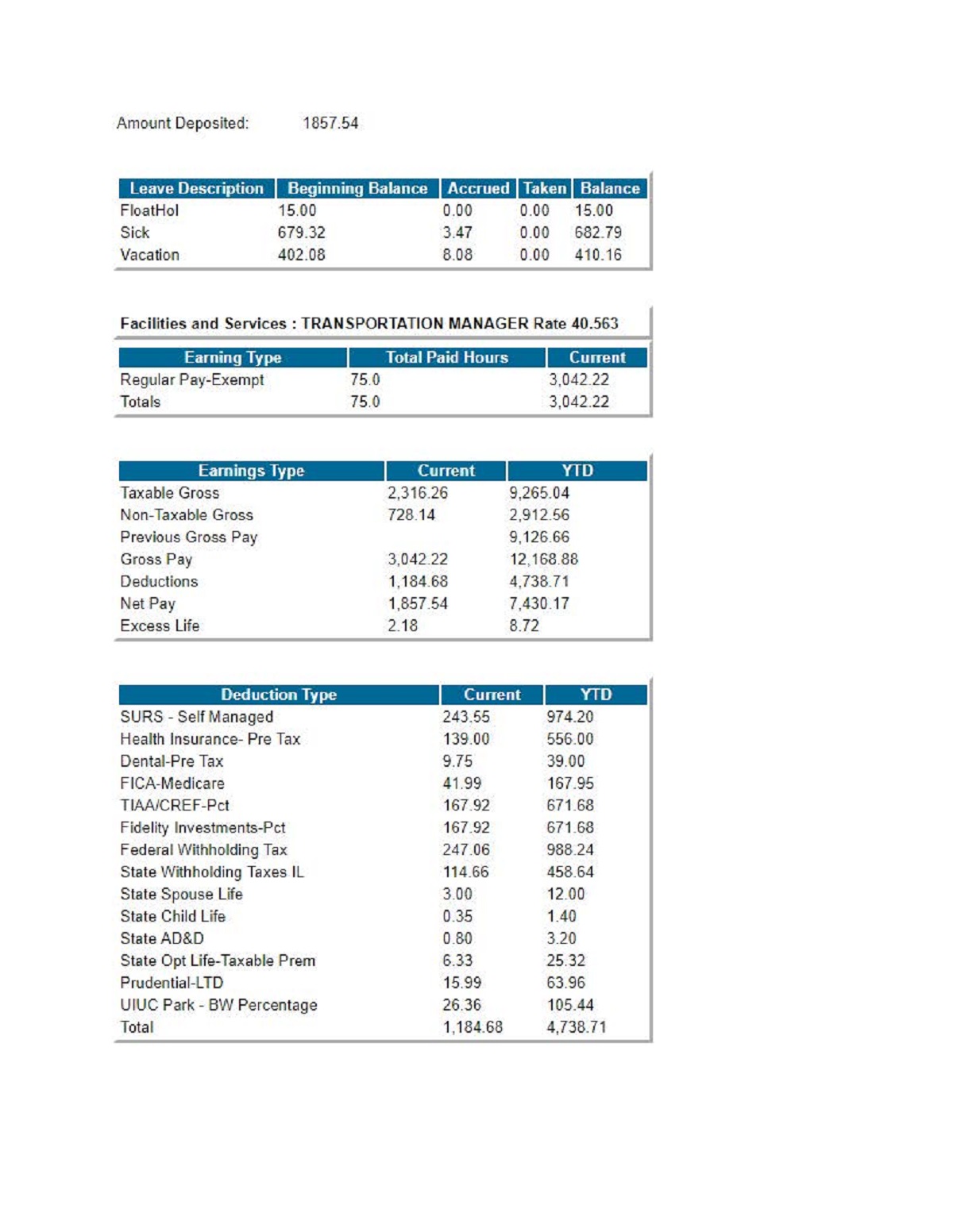

Sample Statement Obfs

W2 Box 1 National Sick Pay

Third Party Sick Pay Reporting Faqs American Fidelity

Understanding Third Party Sick Pay Genesis Hr Solutions

What Is Third Party Sick Pay

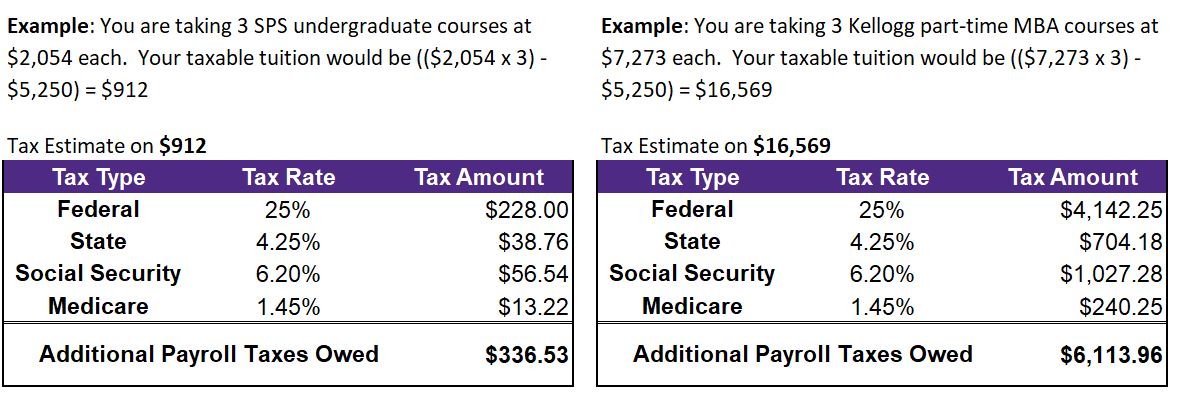

Tuition Taxation Human Resources Northwestern University

What Is Taxable Income Mintlife Blog

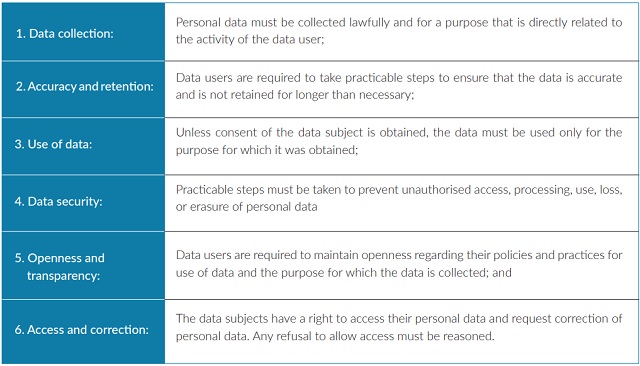

The Hong Kong Employment Law Handbook Covid 19 Edition Employment And Hr Hong Kong